“Our team is thrilled to partner with our members to provide up-to-date business practices that cater to the ever-changing needs of the electric industry.” – Walter West

The electric vehicle (EV) industry is expanding rapidly, resulting in more EV products being available in the market. As a result, there will be an increased need for EV charging, and ECG is committed to serving as a trustworthy source of information on charging technology and best practices.

EV Trends

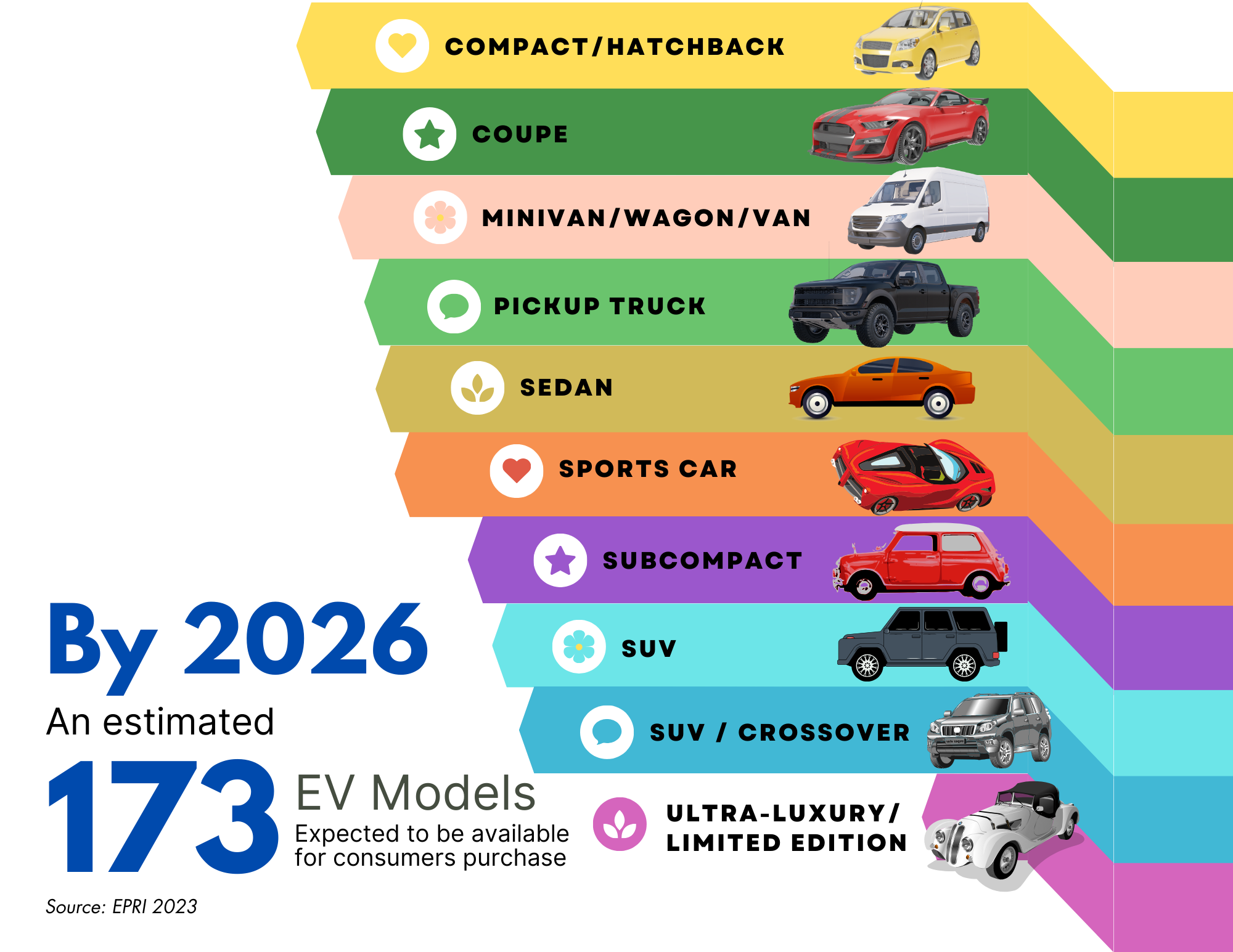

In September 2023, the Electric Power Research Institute (EPRI) published a Consumer Guide to Electric Vehicles. Key findings suggest that an estimated 173 EV models are expected to be available for consumer purchase by 2026, and the average range is expected to increase from 246 miles in 2021 to 270 miles in 2024.

Additionally, in March 2022, EPRI published a Consumer Guide to Commercial and Industrial On-Road Electric Vehicles. EV fleet vehicles incorporated in the study include Pick Up Trucks, SUVs, Buses, Delivery Vehicles, Over-The-Road Tractors, and Fire Trucks. As of 2023, an estimated 80 unique EV fleet vehicles are available for public consumption. Studies suggest that fleet vehicle adoption is likely to occur much faster than consumer adoption.

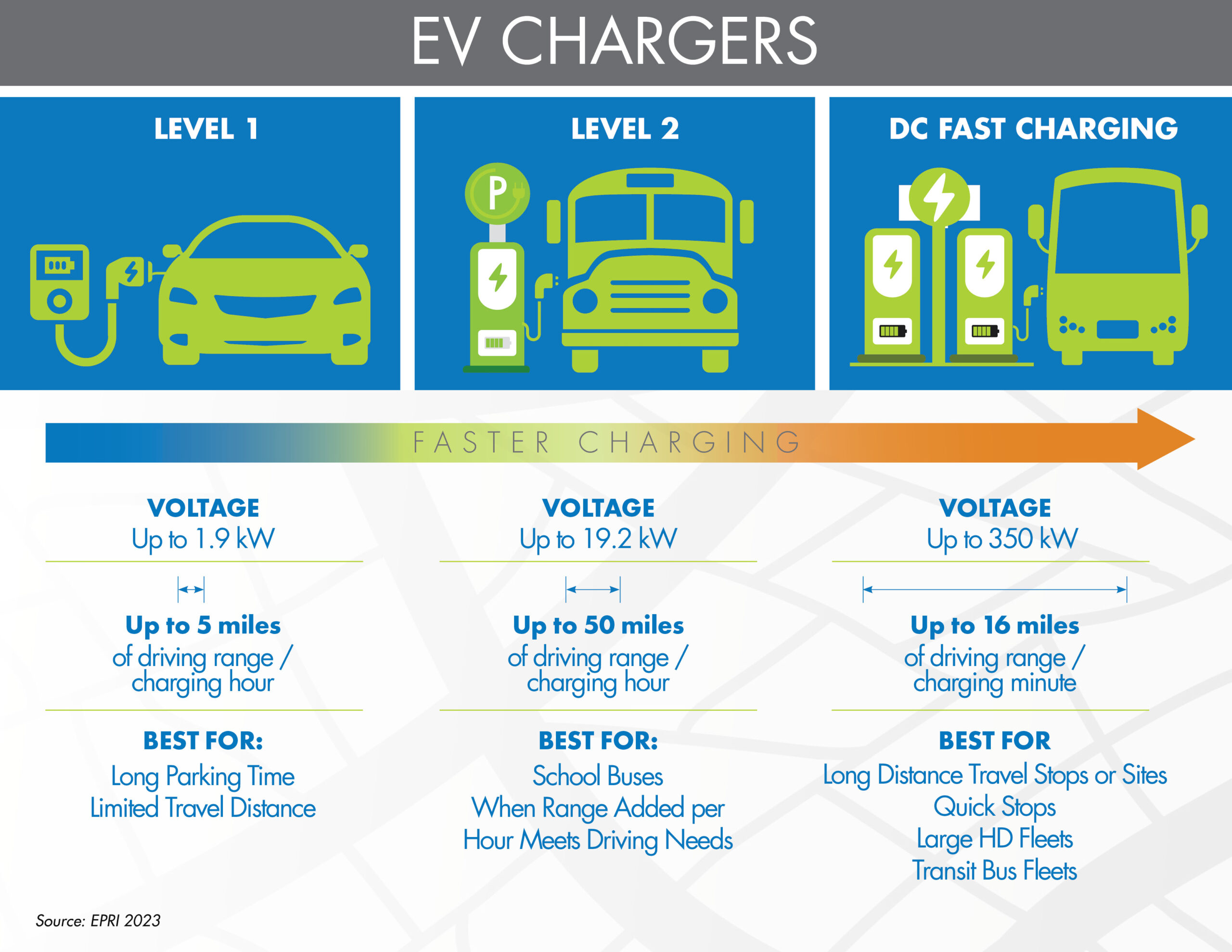

The need for Level 2 and Level 3 chargers will continue to increase as consumers and industries adopt EVs. For comparison, Level 2 chargers use roughly the same amount of power as a hot tub or electric water heater, while Level 3 DC Fast Chargers use roughly the same amount of power as a convenience store (at peak levels).

Additionally, the Department of Energy (DOE), predicts as much as 90% of electric car charging is done overnight at home, and chargers used at home are typically a level 1 or level 2 charger. This may reduce the use of public charging stations but also may increase the need for policy on installing level 2 chargers for private use

As EVs and the need for EV charging become more prevalent, utility enterprise communities will need to plan and budget for future infrastructure improvements. Additionally, developing partnerships with public and private organizations that plan to adopt EVs can be crucial to setting realistic expectations and developing feasible outcomes relating to EV charging. However, it is important to note that the deployment of EVs and EV chargers will not happen all at once, and there is time to prepare.

Legislative update

In May 2023, GA Senate Bill 146 was signed into law, which regulates and taxes electric vehicle charging stations in the same manner as retail fuel pumps. There are three parts to the law, and each have different implications:

Part I of the law was effective as of July 1, 2023, but the law only affects Georgia Power. The law permits the following:

- Community chargers are approved by the PSC for Georgia Power.

- If Georgia Power operates a charging facility, outside of public chargers, those services must be set up as a separate legal entity.

- Charging vehicles by kwh does not violate the Georgia Territorial Act.

- Georgia Power must offer its subsidiary services under the same rates, terms, and conditions as any other provider of electric vehicle charging services.

Part II of the law goes into effect January 1, 2025, and the law permits the following:

- Department of Agriculture the authority to perform inspections of public electric vehicle charging stations, share information with the Department of Revenue to enforce Motor Vehicle Sales Tax Law, and file for an injunction to stop charging stations from operating if the charging station violates the law.

- Requires electricity use to be measured on electric vehicle charging stations on a per kilowatt-hour basis. Failure to accurately measure the amount of electricity, within the tolerance established by the Department of Agriculture, may result in condemnation of the electric vehicle charging equipment.

- Advertising prices for charging stations shall be a total price, including taxes. The charging provider can offer discounts from an advertised price if the purchaser of electricity buys additional merchandise. However, it is unlawful for any charging provider to advertise the purchase of free gifts or other products unless there are sufficient quantities of the product to supply reasonable demand. For example, free car washes may not be offered unless the provider can offer it at time of purchase.

Part III of the law is also effective January 1, 2025. Part III states that electricity used as motor fuel shall be subject to motor fuel taxes, and that the Department of Revenue shall have jurisdiction over the taxes assessed for electricity used as motor fuel.

ECG Services

ECG provides a range of services that help our members access essential industry data and resources. We aim to work closely with our members and strategic partners to create thriving communities with economic opportunities and success. We work collaboratively with our members and strategic partners to create thriving communities with economic prosperity and opportunity.

Click on the icon below to view more information on each service.

Additional Resources

National Electric Vehicle Infrastructure (NEVI)

Electric Power Research Institute (EPRI)

American Public Power Association (APPA)

Jon R. McBrayer, MPA

Manager, Community Development

Jon R. McBrayer, MPA